I put my house up for sale about a month ago. I had high hopes. My house is a gem (or so I thought.) A big log cabin on 19 acres of land—one of the few listings with more than 10 acres.

But within a couple of weeks, my high hopes came crashing down, and reality slapped me across the face.

Nobody Can Afford to Buy a House—Especially Not in Rural, Middle Class or Low-Income Areas

The insanely high house prices, paired with the high interest rates, mean that nobody can qualify for a mortgage. And even if they could, they’d be crazy to take on such a high payment.

I bought my house in 2015. My mortgage, including property tax and insurance, is $1,053 per month. At today’s prices and rates, I’d pay $3,100 for the same house— an almost 300% increase.

You’ve Gotta Sell a House to Buy a House

I made an offer on a new house contingent on selling my house. Someone made an offer on my house contingent on selling their house. Those people received an offer on their house contingent on—you guessed it—selling their house. And so the cycle continues, a never-ending loop of hope and disappointment.

Nobody will be moving unless someone in my (very rural) town can whip out a half million dollars to buy one of these houses. And seeing as the median household income is $60,000, that seems unlikely.

I’m fortunate in this situation, though. My husband and I don’t need to sell. We were testing the waters—seeing if we could sell our house for enough to pay off our mortgage and buy a different home. The plan might work out. Or, the loop of contingencies may never end.

Either way, I can’t imagine what it must feel like to be a first-time home buyer in 2024.

Good Deals are Hard to Find

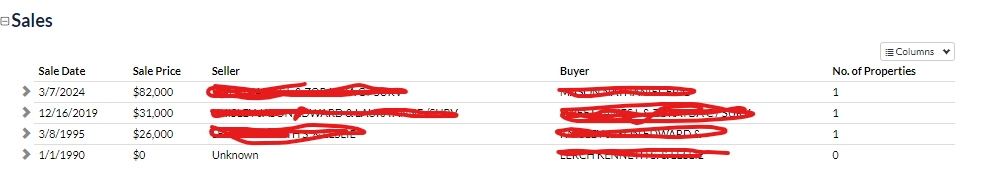

My brother was fortunate enough to buy his first house this year, snagging a rental off a landlord for $82,000. It’s a smaller house but in a nice enough neighborhood, and he quickly spruced up the place with a good scrubbing, some paint, and new floors.

But it took me a year of checking the MLS daily to find a three-bedroom property that was less than $100,000 and not in shambles, and I haven’t seen one since. And while you might think that $82,000 is one hell of a deal, the landlord bought the home in 2019 for $31,000—a 264% price increase in five years.

(And yes, getting smaller houses with minimal land for $50k or less five years ago was very common.)

What are the Options for Those Needing Housing?

Buying a new house means nothing if you don’t have the money to cover the mortgage. Before you put pen to paper and take out a loan that will make you house-poor, consider these options.

Keep Renting

Rent increases are almost as bad as house prices and mortgage rates—although it’s harder to find concrete data on rental prices. (Based on my area’s Facebook marketplace advertisements, rent has at least doubled over the past five years.)

However, you have an advantage if you’re still paying pre-2021 rates. In this case, keep your low(er) cost rental and stash as much money in savings as possible.

Purchase a Much Cheaper/Lesser of a House than You Initially Wanted

Five years ago, $80,000 would’ve gotten me at least an acre of land somewhere in the country. Today, that $80k can get me a small parcel in town. That’s the situation my brother found himself in—what he bought was far from his dream home but gave him low-cost housing. (His mortgage is about half of what he’d pay in rent for a three-bedroom home.)

You might be in the same situation.

Rather than getting your dream house, you might need to get something less than what you pictured. Think of it like a stepping stone—find something where the mortgage will be cheaper than you’d pay for rent. Then, save as much money as possible. When you get a good amount of cash stashed away, and interest rates drop a little, sell the house you bought and upgrade to something else.

Buy a Tiny House

If you have land, tiny houses are always an option. They can be permanent or temporary solutions. Here’s a list of tiny house kits I compiled last year. You’ll need to build these homes, but there are plenty of options to choose from.

Live in an RV Temporarily

If you have an RV and are trying to save money to buy a house, living in it temporarily might be tough, but it is a way to avoid astronomical rent prices. Rather than paying rent, you can pay a small lot fee somewhere for hooking up to water and electricity and add the rent money to your house savings account.

Save as Much Money as Possible and Cross Your Fingers for Lower Prices or Lower Interest Rates

We’re currently experiencing high mortgage interest rates and record-breaking house prices nationwide. According to Yahoo Finance, mortgage rates are expected to drop slightly (about 0.5%) over the next year. We can only hope that house prices will drop a bit, making homes affordable enough to buy and sell. (Because it’s hard to sell a house when nobody has the money to buy it!)

Either way, if you’re looking to buy in the near future, start making the tough decisions now. Squirrel away as much money as possible, and keep your eye out for good deals because finding one will probably take a while.

The post I Tried to Sell My House—Now I Feel Bad for First-Time Home Buyers appeared first on Homedit.